Registration and protection of IP assets (trademarks, patents, domain names, data bases, software programs, general copyright, plant variety protection, industrial models and designs).

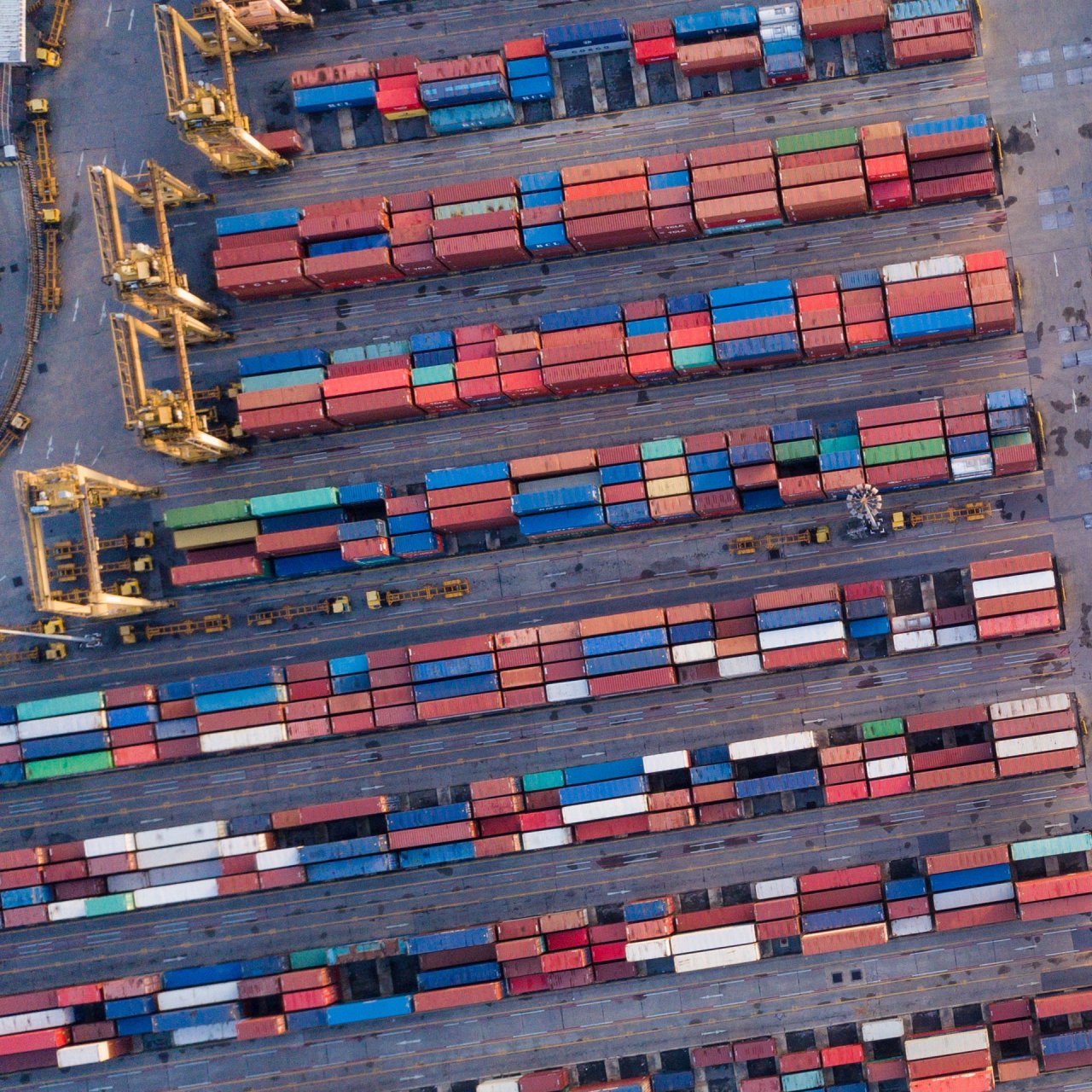

Tax burden on investment projects, economic transactions and financial operations such as leasing, trust, intercompany loans and corporate financing.

Creativity, diversity, integrity, proactivity, teamwork, curiosity and innovation are just some of the characteristics of our tax team.

We enjoy working side-by-side with our clients analyzing complex, day-to-day queries and creating value while strengthening the role and visibility of their in-house lawyers and accountants.

We pride ourselves on anticipating our clients' needs, taking proactivity to a whole new level.

We focus on building teams, selecting the right assets within the firm and our clients to be able to evaluate their businesses without the typical constraints of traditional tax planning.

Our team is comprised of specialists in the various areas of tax law covering local and international tax planning issues and complex litigation at the national, provincial and municipal levels. The services provided by the tax sector include the effective structuring of investment projects (local and foreign), advice on financial structures to international companies and banks, structuring of mining projects and reorganizations.

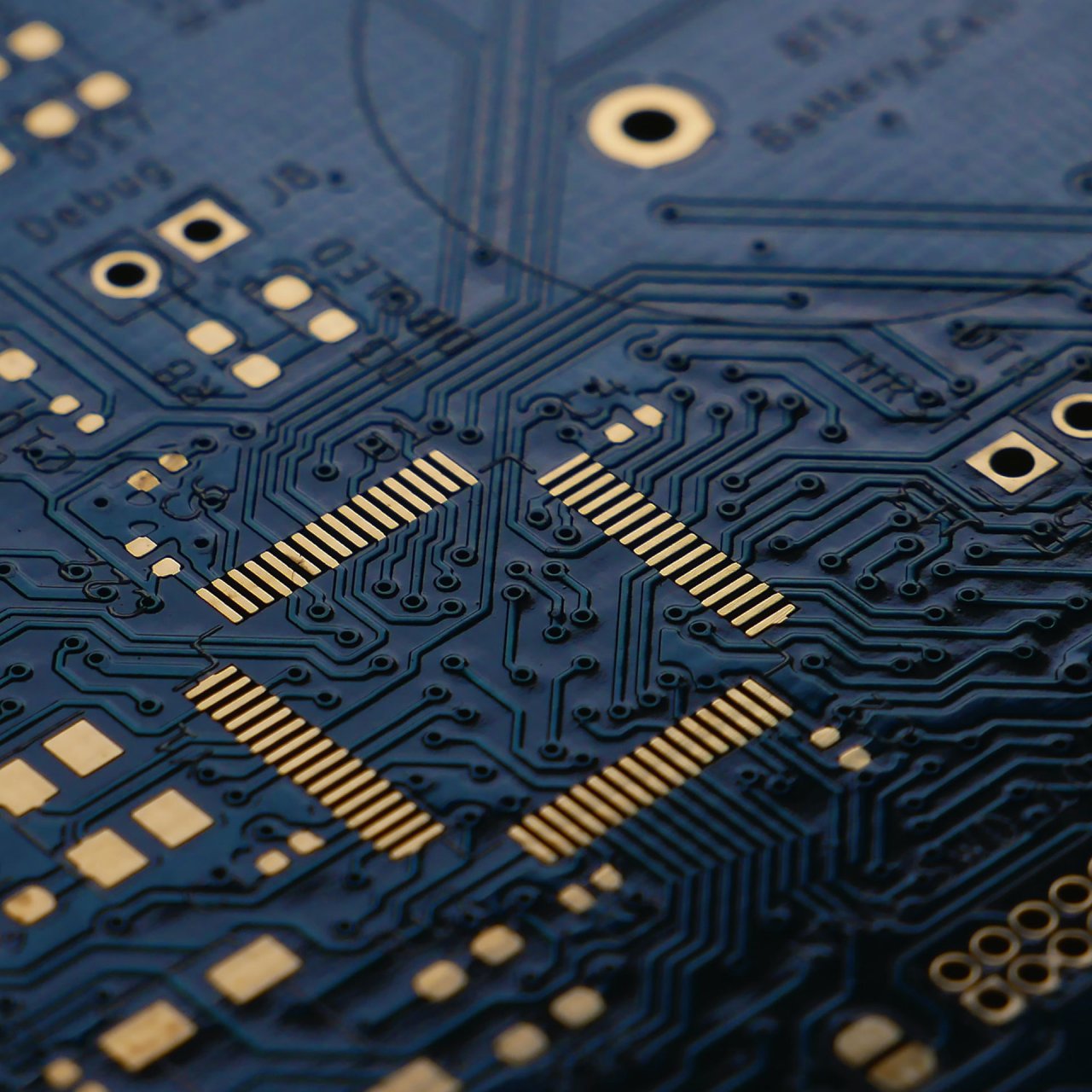

Special focus is given to entrepreneurs and technology companies in their gradual growth from their start-up to the unicorn stage, accompanying the companies in all their growth stages.